When the Public Works Assistance Account (PWAA) was established in 1985, it was funded by small increases in utility and real estate excise taxes. Here are links to the funding legislation, along with the amounts that formerly went to fund loans:

• Real Estate Excise Tax or REET: (RCW 82.45.060) 6.1% of the REET collected

• Public Utility Tax: (RCW 82.16.020) 0.94% water tax, 2.16% sewer tax

• Solid Waste Collection Tax: (RCW 82.18.020) 3.6% solid waste (SW) tax

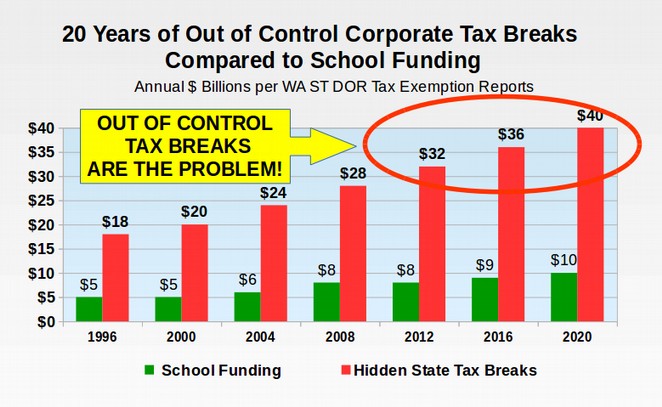

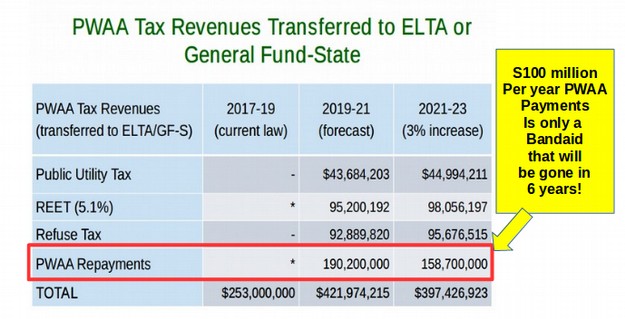

Recently these sources of funding have been almost entirely diverted. Currently the only money going into the Public Works Trust Fund account is a small 2% of the REET and loan repayments from the past 30 years of loans. Even these loan repayments of about $200 million per year have been “swept” from the Trust Fund because the Trust Fund is not a “protected” Trust Fund. The Public Works Trust Fund therefore has been repeatedly gutted by our State legislature to backfill for hunderds of tax exemptions like the billion dollar per year Boeing Tax Break. Virtually every part of our government from public schools to public works has been gutted in order to pay for these 700 tax breaks to wealthy corporations. These hidden tax breaks for the rich now cost our state almost $40 billion per year.

History of the Public Works Trust Fund Train Wreck

PWAA was established because local agencies such as small cities and counties were not able to fund critical Public Works projects essential to public health and safety.

We are now dealing with how to repair or replace aging infrastructure with very high replacement costs. The removal of this funding for Public Works projects is certain to result in system failures all across our state which will harm public health and safety.

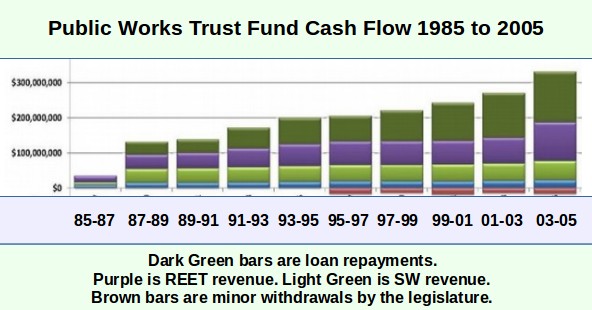

For the first 10 years, the Public Works Trust Fund had a stable source of funding from Real Estate Excise and Solid Waste Taxes of about $100 million per year. By 1995, this created a total fund balance of nearly one billion dollars for Public Works projects. While there were small withdrawals during the second 10 years, they were offset by increases in the Real Estate Excise and Solid Waste Taxes so that by 2005, there was more than $2 billion in the Public Works Trust Fund. Here is a graph of these first 20 years:

Then the trouble began.

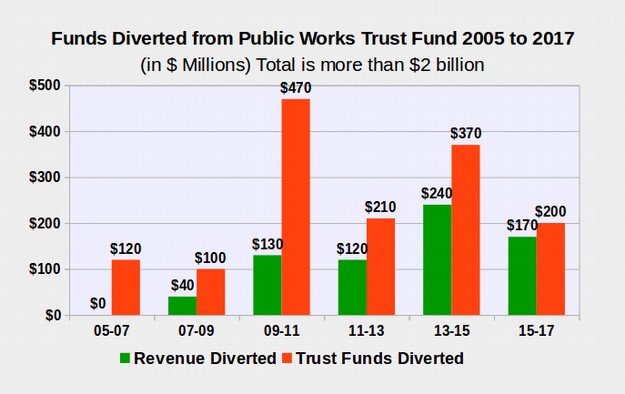

The 2005-2007 legislature withdrew $120 million from the Trust Fund.

The 2007–2009 legislature withdrew another $100 million.

The 2009–2011 legislature withdrew another $470 million.

The 2011-2013 legislature withdrew another $210 million.

The 2013-2015 legislature withdrew another $370 million.

The 2015-2017 legislature withdrew another $200 million.

Here is a table of funds going in and out of the Trust Fund in the past 12 years in millions of dollars per biennium:

| Biennium |

Loan Repayments IN |

REET SW Revenue IN |

REET SW Revenue Diverted |

Trust Funds Diverted OUT |

Total Diverted $ Millions |

| 05-07 |

200 |

200 |

0 |

-120 |

-120 |

| 07-09 |

200 |

160 |

-40 |

-100 |

-140 |

| 09-11 |

240 |

70 |

-130 |

-470 |

-600 |

| 11-13 |

200 |

100 |

-100 |

-210 |

-310 |

| 13-15 |

270 |

30 |

-240 |

-370 |

-610 |

| 15-17 |

200 |

30 |

-170 |

-200 |

-370 |

| Total |

$1,330 |

$570 |

$-700 |

$-1,470 |

$-2,150 |

These diversions of funds were in addition to transferring $250 million from the Toxic Cleanup fund since 2007. Thus, more than $2.2 billion has been diverted away from the Public Works Trust fund during the past 12 years – leaving only about $660 million left in the Trust Fund. Here is a graph of funds diverted by the legislature away from the Public Works Trust Fund during the past 12 years.

Source: http://www.pwb.wa.gov/Documents/10-07-2016-PWB-Agenda-Packet.pdf

Because of these transfers, the Public Works Board was $60 million in the red by May 2016. In addition, the state was forced to borrow $158 million at 4% so that the Public Works Board could fulfill their loan obligations. This is thus a very expensive shell game that only benefits Wall Street banks – at a huge cost to Washington State tax payers.

Like a public bank, in addition to financing billions in local public works projects, the Public Works Trust fund generated about $200 million per year in additional revenue. But instead of leaving this revenue in the Public Works Trust fund to be used for future public works projects, the legislature has for the past six years withdrawn about $200 million per year from the Public Works Trust Fund for a total withdrawal of about $1.5 billion dollars. In addition, the legislature has diverted over $700 million in revenue away from the Public Works Trust fund for a total diversion of $2.2 billion. This only leaves about $660 million left in the Public Works Trust Fund. Even that small amount is at risk if the sweeping is allowed to continue for the next six years.

The next graph shows the public works investments by county facilitiated by the Public Works Trust Fund during the past 20 years. Without this crucial fund, the cost of public works projects for the next 20 years will be much higher than it has been in the past.

Public Works Trust Fund Investments 1985 to 2014

https://app.leg.wa.gov/CMD/Handler.ashx?MethodName=getdocumentcontent&documentId=rXx9fjjLEbc&att=false

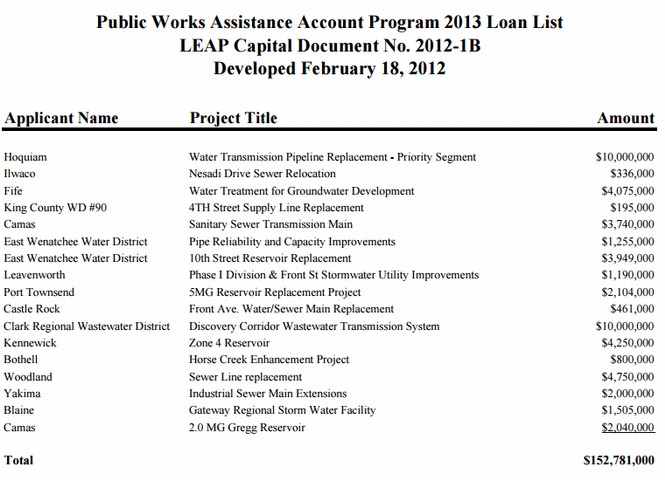

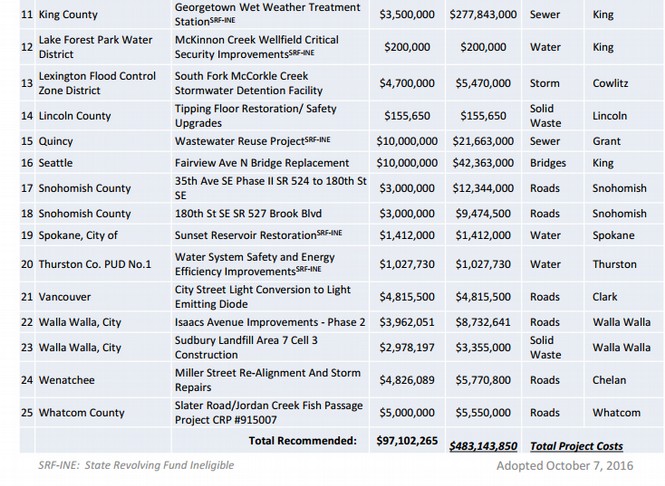

The Public Works Trust Fund operates by getting requests from local governments all over the state. The Public Works Board then developes a list of “recommended projects” which it submits to the legislature for approval. Here is a part of the 2012 list showing that $152 million in public works projects were supported.

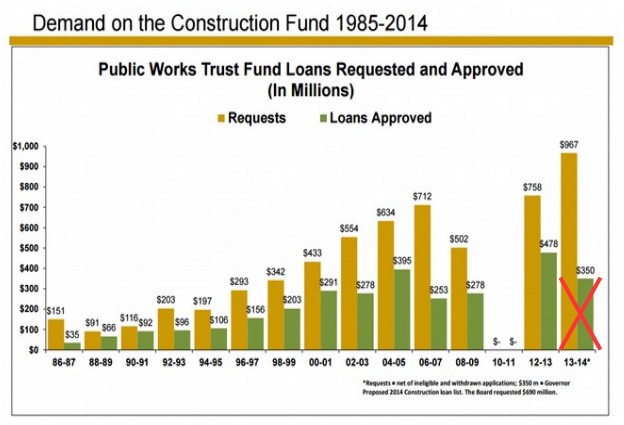

Here is a chart showing the history of requests per biennium and approvals per biennium. Note that only have of the requested projects have actually been funded. During the 2010-2011 biennium, no projects were funded because the entire account was “swept” by the legislature in order to balance the budget.

http://www.pwb.wa.gov/Documents/08-21-2015-PWB-Agenda-Packet.pdf

In the 2013-2014 biennium, there were $967 million in requested projects. Only $350 million were approved by the Public Works Board. However, the 2013 legislature failed to approve any of these projects. Instead, the entire amount of revenue was transferred out of the Public Works Trust Fund in order to pay for things like the billion dollar per year Boeing Tax Break.

$350 million may seem like a lot. But when you divide it by our state’s 7 million people, it is only $50 per person per biennium or $25 per person per year. More important, there is virtually no actual cost to tax payers because the Public Works Fund uses the payments from previous investments to fund new investments. Here is a portion of the October 2016 Recommended Projects list. If a solution is not found to the Public Works Trust fund problem, none of these $483 million in important public works projects will be completed.

The policies of the Public Works Assistance Account are defined in RCW 43.155. Here are some quotes from this law:

RCW 43.155.050 Public Works Assistance Account

“The public works assistance account is hereby established in the state treasury… Money in the public works assistance account shall be used to make loans and to give financial guarantees to local governments for public works projects. Moneys in the account may also be appropriated to provide for state match requirements under federal law ...During the 2015-2017 fiscal biennium, the legislature may transfer from the public works assistance account to the state general fund such amounts as specified by the legislature.”

RCW 43.155.060 Public Works Financing Powers

“In order to aid the financing of public works projects, the board may:

(1) Make low-interest or interest-free loans to local governments from the public works assistance account or other funds and accounts for the purpose of assisting local governments in financing public works projects...Money received from local governments in repayment of loans made under this section shall be paid into the public works assistance account for uses consistent with this chapter.”

What does the future hold for the Public Works Trust Fund?

The 2016 legislature passed Senate Bill 5251 which moved the Drinking Water State Revolving Fund (DWSRF) from the Public Works Board to the Department of Health. This action required the Trust Fund to amend 800 existing contracts and will result in the transfer of hundreds of millions of dollars in public works contracts to the Department of Health – which has never handled public works contracts in the past. It remains to be seen whether the Department of Health will be able to manage all of these contracts.

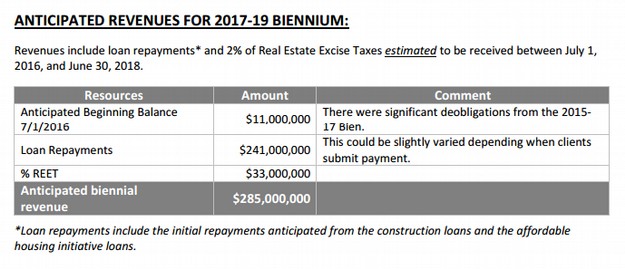

According to the minutes of the July 2016 Public Works Board meeting, there will be $285 million in revenue coming into the Public Works Trust Fund in the next two years:

http://www.pwb.wa.gov/Documents/07-08-2016-PWB-AGENDA-PACKET.pdf

The board proposed to use $10 million of this fund for their operating budget for the next two years ($5 million per year) and then loan out $254 million leaving an end fund balance of $29 million. However, it is likely that the legislature will sweep the entire program, not fund any public works projects and devote the entire $285 billion for other purposes such as the Boeing Tax Break.

Looking to the future, the loan repayments continue to drop each year until by 2026, the loan payments drop from the current $120 million per year to below $100 million per year. Thus, the total revenue available during the next 6 years from past Public Works loans is about $660 million. What happens to these last $660 million in remaining Public Works Trust Fund payments will determine the cost of public works projects and even the availability of public works projects in Washington State for generations to come. There are basically only three options.

#1 First, the legislature can continue to sweep these funds every year until they are gone. Public Works projects will no longer even be available for small communities.

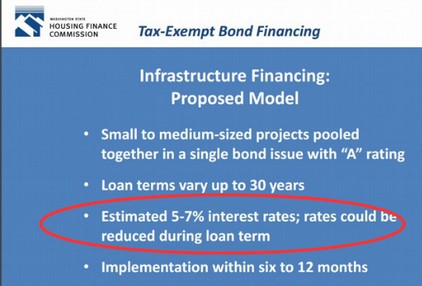

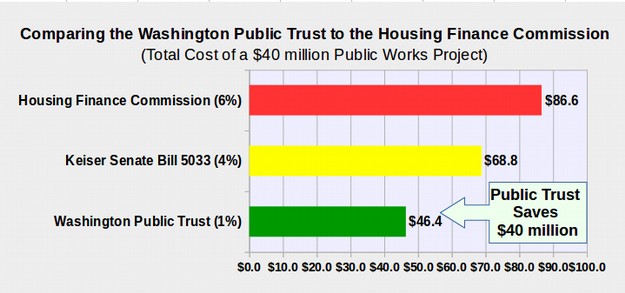

#2 Second, the legislature can transfer the remaining Public Works funds to Public Schools with future Public Works projects handled by the Housing Finance Commission. This will dramatically increase the cost of public works projects by raising the interest rate from 1% to 6%.

#3 Third, we can create the Washington Public Trust, transfer the remaining Public Works Trust Fund to the Public Trust Fund and continue offering public works projects at a 1% rate just as we have for the past 30 years.

2017 Budget Governor’s Plan… Move the remaining Public Works Trust Fund payments to Public Schools and have the Housing Finance Commission handle future Public Works projects – Raising the Interest Rate on Public Works Projects from 1% to 6% - dramatically increasing Utility bills all over Washington State!

Transferring about $100 million per year for the next six years from Public Works payments to Public Schools may seem like a good idea. But it does not even help public schools over the long run because it is only a temporary band-aid fix to a problem that needs a permanent stable funding solution. First, the Governor’s proposal is completely inadequate. It amounts to only $100 per student per year when we need to raise revenue by more than $4,000 per student in order to fully fund our public schools and lower class sizes. But even more important, there are only about six years of Public Works Contract revenues remaining. Once these six years are gone, schools will again face more budget cuts.

Why Raising the Interest Rate on Public Works Projects from 1% to 6% is a very bad idea

Cities, counties and local utility districts have billions of dollars in urgently needed public works projects they need to complete. Moving all future Public Works projects to the Housing Finance Commission would result in the interest rate rising from one percent to six percent. Here is a slide from a February 7 2017 House Capital Budget committee work session on the Housing Finance Commission confirming this fact.

Here is a link to the entire presentation:

https://app.leg.wa.gov/CMD/Handler.ashx?MethodName=getdocumentcontent&documentId=6K2vdE6S9_o&att=false

Many small communities already are forced to charge rural residents up to $200 per month to pay for existing public works projects even at a one percent interest rate. These rates would be forced up even further. Even worse, many local communities who qualified for a one percent rate would not even qualify for the six percent rate – meaning that urgent projects would not even be done – harming the environment and the economy by eliminating public works jobs in small rural communities.

Why would the Governor even propose such a terrible idea?

Perhaps the Governor is not aware that his proposal would raise interest rates on public works projects from one percent to six percent - basically destroying small rural communities all over Washington State. Large urban areas like Seattle would not be adversely affected because they are big enough to arrange their own Public Works financing. But the “reason” the Governor proposed this was an attempt to come up with more money to fund the public schools and meet the McCleary deadline as can be seen from the following presentation.

On January 20, 2017, the House Capital Budget Committee held a hearing on Local Government Infrastructure and the Public Works Trust Fund. The Office of Financial Management gave a presentation on the Governor’s Proposal that can be viewed at the following link:

https://app.leg.wa.gov/CMD/Handler.ashx?MethodName=getdocumentcontent&documentId=kiFHLGX_FgY&att=false

The Governor’s proposal is to redirect Public Works revenues and repayments to the Education Legacy Trust Account (ELTA) or State General Fund.

Future Public Works Projects would be financed through bonds issued by private Wall Street banks through the Housing Finance Commission. We therefore need to take a closer look at the Housing Finance Commission.

A Closer Look at the Housing Finance Commission

On February 7 2017, the House Capital Budget committee held a work session on the Housing Finance Commission. Here is a link to this presentation:

https://app.leg.wa.gov/CMD/Handler.ashx?MethodName=getdocumentcontent&documentId=6K2vdE6S9_o&att=false

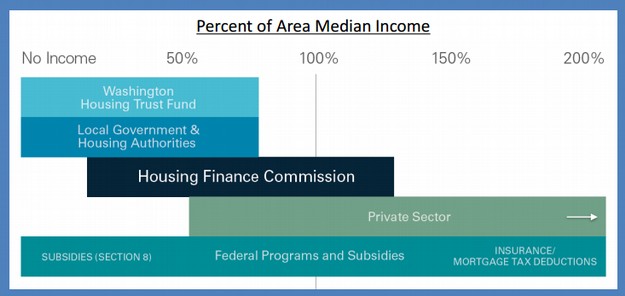

The Housing Finance Commission was established in 1983. It has an 11 member board appointed by the Governor and a huge staff of 70 people. It has “self-generated revenue of $26 million and pass through grants of $7 million. Unlike the Public Works Trust Fund, this is a private sector profit driven program that uses Tax Exempt bonds and federal tax credits to lower rates.

For those who may not know, mortgage backed securities is a form of gambling that lead to the 2008 Economic Crash. They are financial weapons of mass destruction. Given the harm they have inflicted on our economy, many of us feel they should not even be legal.

The Housing Finance Commission serves people in the middle income bracket with incomes up to $90K per year:

Since when is $90,000 per year considered low income???

They manage about $4 billion in bonds at any given time. The Housing Finance Commission appears to be mainly a way for wealthy investors to get tax credits and tax exempt bonds. They claim they can take over the Public Works Trust Fund with no problems. However, as we have noted above, they estimate the interest rates on the Public Works bonds would be about 6%.

What about using traditional Wall Street Bank bonding for Public Works Projects?

At a 2016 Board meeting, Public Works Board member Mary Margaret Haugen stated that her concern is the legislature “doing the bond thing. Bonds are the worst of the worst, and I think this is just a train wreck going forward. It’s creating another monster”… Blair Burroughs responded that “the reason the legislature is looking toward bonding is because rates are so low right now. But if they go back to historic rates, they will end up costing locals far more in the future.”

http://www.pwb.wa.gov/Documents/05-06-2016-PWB-Agenda-Packet.pdf

Why the Washington Public Trust is a Better Option for Public Works Projects than the Housing Finance Commission

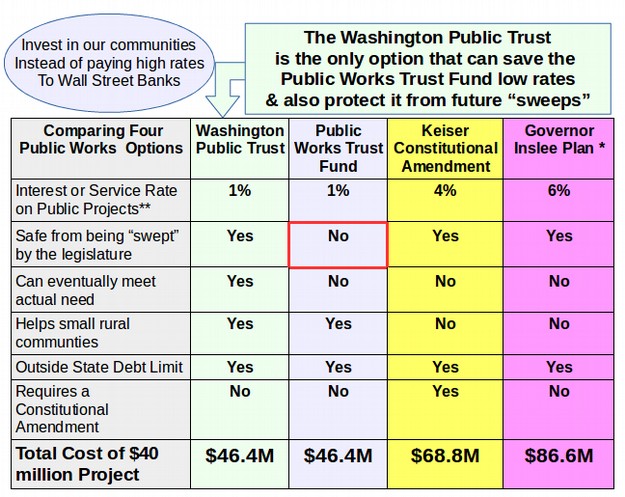

The Washington Public Trust would operate in a manner similar to the current Public Works Trust Fund in that the interest rate would remain at about one percent instead of skyrocketing to six percent. But unlike the current Public Works Trust Fund, the transfer of funds to the state legislature would not be under the direct control of the legislature. Instead, the Washington Public Trust fund would be under the control of a five member Investment Trust Commission of Statewide elected officials. Funds could not be transferred out of the Washington Public Trust fund without a majority vote of this commission (which consists of the governor, the lieutenant governor, the state treasurer, the superintendent of public instruction and the commissioner of public lands).

Thus, the Washington Public Trust would be similar to the Public Bank of North Dakota which is also under the control of a commission of statewide elected leaders. This set of “checks and balances” has worked very will in the State of North Dakota protecting funds needed for financing infrastructure and school funding projects for nearly one hundred years – while still allowing periodic transfer of excess funds to the North Dakota legislature.

But most important, the Washington Public Trust is a better option for Public Works projects than the Housing Finance Commission because small communities that cannot afford or would not qualify for a six percent loan under the Housing Finance Commission would automatically qualify for a one percent loan by the Washington Public Trust. This would keep our money and our jobs working here in our local communities instead of being shipped out of state to reckless Wall Street Banks.

Finally, the Washington Public Trust is a much safer model than the Housing Finance Commission. The Housing Finance Commission is already burdened with more than $4 billion in debt owed to Wall Street banks. This amount of debt would soon double if it took on Public Works projects. Using the Public Trust instead would mean there would be no mortgaged back securities to blow up in our faces. There would also be certainty of repayment since local communities have always paid every contract they have made with the Public Works Trust Fund.

Review of 2017 Capital Budget Bills, Hearings and Votes

There have been a number of bills proposed in the House and Senate this year as “solutions” to the lack of public works infrastructure financing that will result from killing off the Golden Goose of the Public Works Trust Fund. Each of these bills suffers from very serious drawbacks. We will therefore take a brief look at each of these proposals.

House Bill 1051 Infrastructure financing by DeBolt

This bill claims to “improve access and reliability to low-cost financing for local government infrastructure projects.” In fact, it would require a Constitutional amendment. A constitutional amendment requires a two thirds vote of the House and the Senate and a majority vote of the people. This makes constitutional amendments extremely difficult. Given that the public often does not understand the importance of public works projects, even if the bill passed the legislature it would be unlikely to pass the public vote. Even if this bill passed the public vote, it would reduce access to public works projects by placing additional burdens on local communities such as proving that they could not qualify for private financing. The problem with private financing is not qualifying for it. Rather it is that the cost of private financing for public works projects which at 4 to 6% is way too high for many smaller communities.

House Bill 1324/Senate Bill 5088 Local infrastructure financing by Tharinger

(this is the Governor’s proposal to move Public Works to the Housing Finance Commission). As we have previously discussed, moving Public Works projects to the housing finance commission would raise the interest rate from the current one percent to about six percent – severely harming smaller rural communities who can least afford to see their utility rates go through the roof.

House Bill 1677 / Senate Bill 5496 Local infrastructure funding by Peterson

This bill does not substantially change the Public Works Trust fund other than adding a couple of legislators to the board. The bill does not fix the basic problem of the fund being vulnerable to legislature sweeping and it does not restore any real revenue to the fund to make up for the damage done from past sweeps.

Senate Bill 5033 Infrastructure financing by Keiser

This bill claims to “improve access and reliability to low-cost financing for local government infrastructure projects by authorizing public works bonds. This bill is similar to House Bill 1051. It would require a constitutional amendment and would raise the interest rate on public works projects to 4%. It would require a constitutional amendment and it would reduce access to low cost public works loans by placing additional burdens on local communities such as proving that they could not qualify for private financing.

Comparing the Washington Public Trust Option to the Public Works Fund Option, the Keiser Constitutional Amendment and the Housing Finance Commission Option.

The following table summarizes the advantages of the Washington Public Trust Option over three other options:

* Governor Inslee Plan is to transfer the remaining payments owed to the Public Works Trust Fund to the Education Fund and move all future public works projects to the Housing Finance Commission – resulting in much higher public works interest rates for residents in small rural communities.

**The Housing Finance Commission and the Keiser Amendment using bonds through private Wall Street Banks which charge interest on the bonds making them a “debt.” However, the Public Works Trust Fund and the Washington Public Trust do not use private bonds. They are therefore investments rather than debt and the revenue they generate is more accurately called a service fee rather than an interest rate.

Public Hearing Expert Recommends Creating a Public Bank to Protect the Trust Funds

On February 14 2017, there was a hearing in the House Capital Budget committee on these bills. Here is a link to the video:

http://www.tvw.org/watch/?eventID=2017021244

Chair Tharinger stated that “This committee wants to protect the (Public Works) program and protect the revenue streams.”

Frank Coats, the mayor of Wenatchee complained that he did not like the proposal to replace the trust fund with bonds from Wall Street banks because “Bond market lawyers take all of the money.” Several people wanted to retain the Public Works Trust Fund but find a way to prevent the legislature from raiding the trust fund.

At the 46 minute mark of the hearing, Representative Smith asked Scott Merriman with the Office of Financial Management: “Are there any best practices that might assist us in looking for a solution on the Public Works Trust Account in terms of the mechanism that we put in place there?

Scott replied: “Look at what other states have done towards creating a public bank to protect the funds and provides the financial due dilegence. It is going to require a paradim shift to solve tis problem.”

John Widenfeller Thurston Public Utility District stated that “The rate through the Public Works Fund would be 1.5% debt payment of $59K. If we have to go to private bond market, the rate would be 4.9%. This is almost $500,000 over the life of the loan.“

On February 22 or 23, 2017, the House Capital Budget Committee will vote on the above bills related to the Public Works problem. The Senate has not scheduled any votes.

Public Works Trust Fund Board Meeting Suggests Changing the Public Works Fund to a Public Bank

On February 3 2017, there was a Board Meeting of the Public Works Trust Fund. During this meeting, a member suggested that it was time to change to a Public Bank model. Here is a link to the meeting minutes:

http://www.pwb.wa.gov/Documents/02-03-2017-PWB-AGENDA-PACKET.pdf

On Page 11 of the meeting notes, Public Works Board Member, Diane Pottinger complained that her water district, the North City Water District “could not get money to do a maintenance building. We had to go to the bond market for a little over 3%. It would have been nice to go get local money, helping local folks, at a lower interest rate. Our bond is coming out of New York.”

Jeff Clarke, with the Alderwood Water and Waste Water District replied: “Maybe we need to consider forming a state bank.”

Comparing the Cost of a Public Works Project at various Interest Rates

Calculating the payment on a typical 30 year tax exempt municipal bond for a Public Works project through a private bank is slightly different from calculating the loan payment on a home. Instead of having “closing costs” which are added to the cost of the home mortgage and then paid for over time, a public works project pays for bond writers (lawyers) and bond sellers (traders) in addition to paying the interest on the loan from the bond buyer (such as a private bank).

Bond underwriting fees vary, but are about one percent of the bond total. Interest rates also vary but are about 4% per year for tax exempt municipal bonds. In addition to underwriting fees, bonds may also incur counsel fees, travel fees, advising and consulting fees, rating agency fees, bond insurance fees, trustee fees, escrow fees, feasibility fees and bond printing costs. For more on these costs, see

http://msrb.org/msrb1/pdfs/Understanding-Gross-Spread.pdf

Finally, the cost of under writing a bond is much higher for smaller (rural) communities than it is for larger (urban) communties. For example, a study of six small school districts paid “issuance costs of about 9% of the principal on bonds that averaged $2 million each while larger urban school paid an issuance cost of only 1% on bonds that averaged $40 million each. Bonds of $10 million had an issuance cost of 3%. This problem is made even more unfair by the fact that poor rural communties do not have the tax base (property valuations) to make payments on the bonds.

According to the Haas Institute, “Rating agencies charge governments hundreds of millions of dollars each year. Much of these fees fall to agencies’ bottom line while a significant portion would appear to support an analytical process that is unnecessarily labor intensive given the rarity of (municipal bond) defaults.”

http://haasinstitute.berkeley.edu/sites/default/files/haasinstituterefundamerica_doublybound_cost_of_issuingbonds_publish.pdf

Many small communities cannot issue bonds at all – a fact which led to the creation of the Public Works Trust fund back in 1985. Many of these fees are eliminated by the Public Works Trust Fund and/or the Washington Public Trust.

According to the National Association of Counties, the average bond issue in Washington State in 2012 was $39 million.

http://www.eenews.net/assets/2013/04/11/document_gw_02.pdf

To simplify our calculations, we will use a typical bond principal of $40 million and assume that the bond interest and the yield are the same and that the principal of the bond includes the cost of bond writing and selling. There are online calculators to rapidly determine the total interest for a 30 year bond at various interest rates. Here is a link to one: https://www.creditkarma.com/calculators/amortization

A one percent bond over 30 years pays interest of 16% of principal.

A four percent bond over 30 years pays interest of 72% of principal.

A six percent bond over 30 years pays interest of 116% of principal.

The one percent interest payment on a $40 million bond issued by the Public Works Trust Fund is about $6.4 million for a total cost of $46.4 million. By contrast, the total interest on a 4% bond issued by the Kieser bill would be $28.8 million for a total cost of $68.8 million. Even worse, the total cost of interest on a 6% bond through the Housing Finance Commission, as proposed by the Governor, would be $46.6 million for a total cost of $86.6 million. In short, creating a public bank instead of transferring the Public Works loans to the Housing Finance Commission would save local tax payers $40 million on a typical $40 million Public Works bond.

Continuing Public Works Trust Fund Grants to Poor Communities that Can Not Even Afford a One Percent Bond

There are some communities that have such low property valuations that they cannot even afford a one percent bond. Because Public Works projects protect health and safety and benefit everyone in the state, the Public Works Trust Fund has provided grants to these communities. The Washington Public Trust would continue this program by offering up to half of the revenue from repayments in any given year in the form of grants to poor communities. The ranking process for giving these grants must include consideration for the property valuations in the community and current tax rate per thousand of assessed valuation. Therefore wealthy communities like Seattle and Bellevue would never qualify for a grant. But extremely poor rural communities would always be at the top of the list.