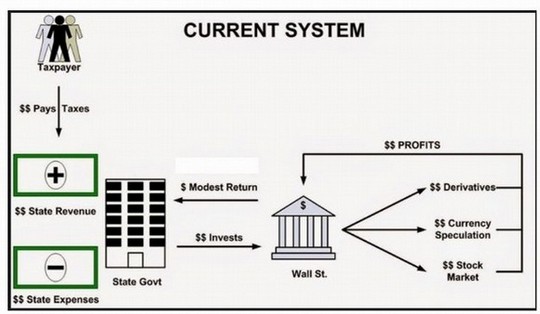

All 50 states, except North Dakota deal with private wall street banking system that works like this:

How our current system works:

1) We pay our taxes / fees and they go to the state government.

2) The state government invests our money in private “Too big to fail” banks.

3) The banks speculates with our money in the stock market and in derivatives, financial gambling instruments, which were part of the cause of the 2008 crisis)

4) The banks profit from our money.

5) We get a modest return.

6) And equally important, because our government doesn't take in enough revenue to pay for infrastructure (like roads and school construction) the city, county and state governments have to issue bonds and we end up paying huge amounts of interest and fees (debt service) to both the banks who write the bond deals and to bond holders.

What is a Bond?

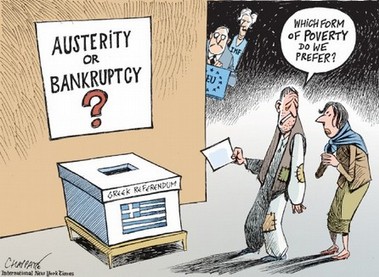

When states, counties, cities or school districts need to raise money to finance new projects, like roads or school construction or to maintain ongoing operations, they typically issue bonds. People invest in bonds and are then known as “bond holders” Bonds are paid off by the tax payers in the state, county, city or school district by a certain date with certain interest rate agreements. If the bonds are defaulted on (not paid back) the bondholders can take the assets…. or the people go under austerity (cuts to services).

Think Greece. In Washington state, no school or city, county or our state has ever defaulted on a bond.

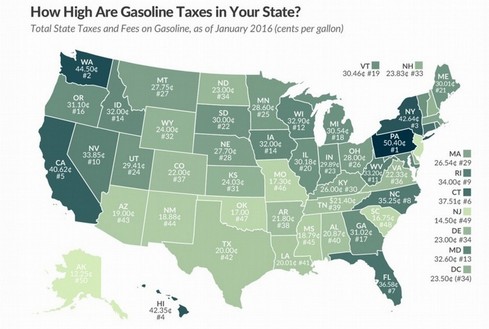

An Example- Our Gas Tax and Bonds for Road Construction – A Bad Situation

The gas tax we pay in Washington State is used for road construction. And we have the second highest gas taxes in the nation at $.44.5 cents per gallon. We would expect to have excellent roads and bridges paying such a high tax. But you know if you live here that we don't. What is going on?

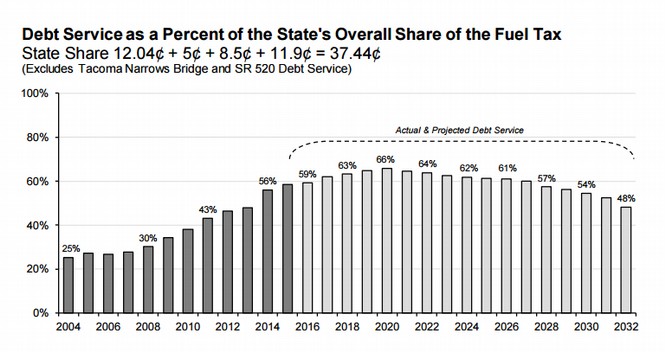

What's going on in Washington State is that most of the money we pay in taxes goes to debt servicing payments on the bonds that the state issued for road construction.

This chart shows us the percentage of our fuel tax dollars that go to paying interest and fees “debt service” to the bond holders and banks as a percentage of all of the fuel taxes we pay:

http://leg.wa.gov/JTC/trm/Documents/TRM%202017%20Update/11%20-%20Bonds%20-%20Final.pdf

Looking at the chart, in 2004 25% of the money that the state collected from fuel taxes went to paying debt service. In 2012 about 45% of the money went to debt service and now, 50-70% of of the gas tax money goes to debt service. That means less than half of the money we pay in our gas taxes goes to building roads!

From the 2014 article “Washinton State Traffic Forecast finally recognizes reality” (where this chart comes from) the writer says:

“For far too long, “build now, pay later” has been the transportation budgeter’s mantra. In the 2000s, for example, Washington committed itself to massive road projects that it didn’t have the money to build. So the state floated bonds, assuming that revenue from gas taxes would show up to pay them off.

That hasn’t worked out so well… Gradually, planners have come to realize that debt service will swallow up most of the state’s gas tax receipts, crowding out everything else. As the chart below shows, WSDOT predicts that within a few years three-quarters of the state’s gas tax receipts will pay for old projects.”

http://www.sightline.org/2014/10/21/washington-state-traffic-forecast-finally-recognizes-reality/

In short, we are paying the wall street banks more in debt service than we are able to use our money to pay for the things we need.

Currently, taxpayers in our State pay about 5% interest on $3 billion in bonds to bond holders and banks every year. If we instead financed our own public bonds, we could cut the interest rate in half, saving our State’s tax payers more than one billion dollars per year in interest payments on bonds – simply by eliminating the Wall Street middle men.

The kind of bank I'm going to describe now goes by these names: Public bank, state bank, infrastructure bank, and investment trust.

Public Banking

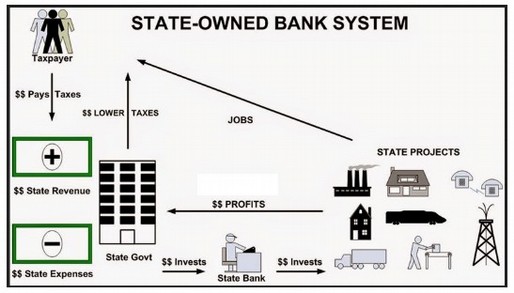

A Washington State Public Bank would allow us to keep our state tax dollars out of the hands of the Wall Street bankers. It works like this:

How a public banking system works:

1) We pay our taxes / fees and they go to the state government.

2) The state government invests our money in a public bank.

3) The public bank issues low interest bonds for public projects, like school construction or roads, and also provides the people with low interest loans for things like mortgages, student loans or business loans. The investment in projects generates jobs which in turn, via taxation, increases state revenue. The only losers in this system are the private big banks and bond dealers / holders.

4) The interest paid back on bonds and loans returns to the public bank, increasing the money available for more low interest loans and bonds.

5) The reason a public bank is able to use money like this is that public banks operate like big banks and the federal reserve bank, both of which use the principle of fractional reserve banking.

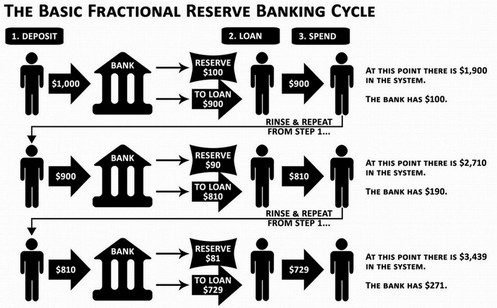

Fractional Reserve Banking

Fractional reserve banking means that a bank holds back a fraction of their deposits on hand and loans out the rest. In other words, only a fraction of the deposit is kept in actual cash in the bank. The theory is that it is highly unlikely on any given day that all of the people will all come in to take out all of their money, also known as a bank run. To illustrate how fractional reserve banking works, let's use 10% as the amount of money a bank has on hand, its reserve requirement. 10% is as an easy number to work with.

In fractional reserve banking, our usual system, when you deposit $100, the bank holds back $10 and loans out the other $90. At this point there is $90 in the community and $10 in the bank.

If the person who took out the $90 deposits it in a bank, there is $19 in the bank(s) and then that bank loans out $81 and now there is $171 in the system. This keeps continuing.

Here is another view of fractional reserve banking:

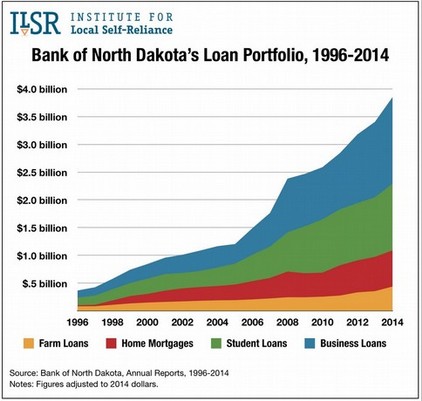

The Bank of North Dakota

The bank of North Dakota, a public bank, uses fractional reserve banking and returns millions of dollars in profits to the people of North Dakota – Again when people pay back their loans and bonds to a public banks, the interest is benefits the public, no middle people, no speculation.

In addition to providing low cost bonds for the building of public schools and public roads in North Dakota, here is its loan portfolio from 1996-2014:

Notice how billions of dollars are invested in low interest student loans and in business loans, not to mention home morgages and farm loans.

Ellen Brown, author of the best-selling book “Web of Debt”, which explains public banking, wrote recently about the public bank in North Dakota:

“In 2015, the North Dakota legislature established a BND (Bank of North Dakota) Infrastructure Loan Fund program that made $50 million in funds available to communities with a population of less than 2,000, and $100 million available to communities with a population greater than 2,000. These loans have a 2% fixed interest rate and a term of up to 30 years. The proceeds can be used for the new construction of water and treatment plants, sewer and water lines, transportation infrastructure and other infrastructure needs to support new growth in a community.”

http://www.counterpunch.org/2017/01/27/how-to-cut-infrastructure-costs-in-half/

Why do we need a Public Bank in Washington State?

We have gone for more than 100 years in Washington state ever since we were granted Statehood in 1889 without a public bank. So why do we need a public bank now? The answer is that our state is facing economic problems which are greater than any time in our history.

Over half of public schools are more than 50 years old. They do not meet earthquake codes or health codes. They are so unsafe that they place the lives of 500,000 students at risk should a major quake occur while the children are at school. It would take more than $30 billion to replace all of these crumbing schools.

We also have a $20 billion road construction and repair backlog. Half of our bridges are also more than 50 years old and would collapse in the event of a major earthquake. We are already paying more than $2 billion per year just in interest payments to Wall Street banks from past loans. We as a State simply cannot afford to continue squandering billions of dollars every year to payments to greedy Wall Street bankers when a public bank would allow us to build public schools and roads with no interest charges. Below are just a few of many benefits of creating our own public bank.

First, we could build schools and roads for half the cost – or build twice as many schools and roads! The concentration of wealthy and power in the hands of Wall Street banks is greater now than at any time in our nation's history.

A public bank would allow us to build public schools and public roads without being fleeced by the private Wall Street banking monopoly. Currently almost half the cost of all public schools and roads goes simply to pay off the bonds of the Wall Street banks. If we loaned the money to ourselves, we could eliminate these greedy bankers and return the money to the tax payers by lowering the cost of public projects. Alternately, we could build twice as many public projects with the same amount of money.

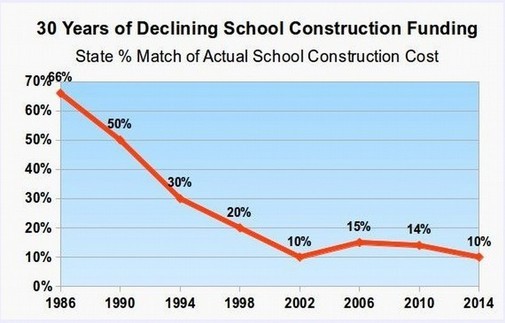

Second, we could lower local property taxes. Because our state is at the debt limit, the state school construction matching funds have fallen from 67% of the actual cost of building schools in the 1980s to less than 10% of the actual cost of building schools today. As a consequence of the state failure to help build schools, local homeowners have been forced to pick up the difference through skyrocketing local property taxes in order to pay off the Wall Street banks in a vicious cycle of debt induced slavery. If we had a public bank, there would be no need to increase local property taxes – in fact, we could cut local property taxes in half. Eventually, we would become like North Dakota which has virtually no debt and therefore has very low taxes.

https://coalitiontoprotectourpublicschools.org/restore-school-funding/washington-state-school-construction-shortfall-exceeds-22-billion-dollars

Third, starting a public bank would allow us to create more than one hundred thousand new good paying jobs – building the schools our kids need and the roads that the rest of us need to get to and from work.

Fourth, we could reduce our dependence on greedy corrupt Wall Street banks.

The reason Wall Street banks were given billions of dollars in bailouts in the past few years is because we do not have a public banking system to fall back on when private for profit banks go broke. Starting a public banking system will allow our economy to grow even if the greedy Wall Street banks gamble away all of their profits and go broke. It is much safer to invest our tax dollars right here in Washington state helping build our local schools and roads than to hand our money over to Wall Street bankers who will gamble it away in a reckless drive to maximize profits.

Put Our Tax Dollars to Work for Us – Interest earned from investments made by a Public Bank would be returned to the State’s general fund and put to work right here in Washington. The North Dakota State Bank returned over $300 million dollars to the State in the last decade. With our larger population, a Washington State Bank could generate even more revenue, stabilize our economy, and avoid tax increases.

Senator Hasegawa sponsored a public bank bill in January 2017 and has 16 co-sponsers in the Senate so far. See here for more details on Senate Bill 5464. Now is the time to get a public bank in Washington state.

http://sdc.wastateleg.org/hasegawa/2017/01/25/state-bank-would-keep-washington-dollars-working-for-the-people/