How the Washington Public Trust Can Save the 2017 Legislature

The 2017 Washington State legislature is facing several crucial problems in what might best be described as a “perfect storm” of over-lapping emergencies. First, legislators must deal with the McCleary school funding deadline. Second, because the past six legislatures have “swept” the Public Works Trust Fund of nearly one billion dollars, the Public Works Trust Fund is facing imminent collapse. Third, school construction in our state is also facing a major crisis. Thankfully, there is a solution to all three of these problems. A public bank, like the Public Bank of North Dakota, would eventually generate billions of dollars in additional revenue – money we are currently giving to Wall Street banks in the form of billions of dollars in interest payments. In addition, a public bank could be used to rescue the Public Works Trust fund by allowing the remaining funds to be re-used and recycled in a more efficient manner. A public bank would also allow us to re-use and recycle the School Construction Fund in a more efficient manner. The clear advantages of a creating a public bank have led to the Washington Investment Trust proposal (Senate Bill 5464/House Bill 2059). However, two concerns have been raised which make passage of the bill in its current form unlikely. These concerns were: #1… The Washington Investment Trust bill is too broadly written. #2… The Washington Investment Trust bill does not specify a source of capitalization.The Washington Public Trust addresses these concerns by being limited to only Public Works and Public School projects and by using two specific sources of capitalization – “recycling” the remaining Public Works Trust Fund and utilizing the remaining School Construction Fund. In Section 1 of this report, we clarify the differences between the Washington Public Trust and the Washington Investment Trust. In Section 2, we explain how the Washington Public Trust can be used to rescue the Public Works Trust Fund. In Section 3, we explain how the Washington Public Trust can be used to more efficiently utilize the School Construction Fund. Section 4 is the proposed language for the Washington Public Trust bill. We hope that this report will help legislators better understand how the Washington Public Trust can be an important solution to the urgent problems they are facing in the 2017 legislative session.

The 2017 Washington State legislature is facing several crucial problems in what might best be described as a “perfect storm” of over-lapping emergencies. First, legislators must deal with the McCleary school funding deadline. Second, because the past six legislatures have “swept” the Public Works Trust Fund of nearly one billion dollars, the Public Works Trust Fund is facing imminent collapse. Third, school construction in our state is also facing a major crisis. Thankfully, there is a solution to all three of these problems. A public bank, like the Public Bank of North Dakota, would eventually generate billions of dollars in additional revenue – money we are currently giving to Wall Street banks in the form of billions of dollars in interest payments. In addition, a public bank could be used to rescue the Public Works Trust fund by allowing the remaining funds to be re-used and recycled in a more efficient manner. A public bank would also allow us to re-use and recycle the School Construction Fund in a more efficient manner. The clear advantages of a creating a public bank have led to the Washington Investment Trust proposal (Senate Bill 5464/House Bill 2059). However, two concerns have been raised which make passage of the bill in its current form unlikely. These concerns were: #1… The Washington Investment Trust bill is too broadly written. #2… The Washington Investment Trust bill does not specify a source of capitalization.The Washington Public Trust addresses these concerns by being limited to only Public Works and Public School projects and by using two specific sources of capitalization – “recycling” the remaining Public Works Trust Fund and utilizing the remaining School Construction Fund. In Section 1 of this report, we clarify the differences between the Washington Public Trust and the Washington Investment Trust. In Section 2, we explain how the Washington Public Trust can be used to rescue the Public Works Trust Fund. In Section 3, we explain how the Washington Public Trust can be used to more efficiently utilize the School Construction Fund. Section 4 is the proposed language for the Washington Public Trust bill. We hope that this report will help legislators better understand how the Washington Public Trust can be an important solution to the urgent problems they are facing in the 2017 legislative session.

The purpose of the Washington Public Trust bill is to address various concerns raised by legislators in regards to the Washington Investment Trust bill (SB 5464/HB 2059). These concerns raised in both the House and Senate hearings in February 2017 were that the Washington Investment Trust bill is too broadly written and may raise Constitutional and other legal questions. In particular, concerns were raised about Section 1, Part 1 b which would permit the Washington Investment Trust to partner with “community based organizations and other stakeholder groups.” Therefore the Washington Public Trust bill is much more narrowly focused on supporting public projects. The Public Trust is specifically limited to projects already financed by the State including the Washington Public Works Trust and the Washington School Construction program. Limiting the Washington Public Trust to purely public works projects should greatly reduce or eliminate any potential legal challenges or questions. The second concern was that the Washington Investment Trust bill did not specify a definite source of capitalization. By contrast, the Washington Public Trust clearly defines two sources of capitalization. These are recycling the Public Works Trust Fund which is transferred along with all outstanding contracts to the Washington Public Trust – and the Washington School Construction Fund which is transferred along with all existing contracts to the Washington Public Trust . The Washingtin Public Trust is basically a combination of the Public Works Trust Fund and the Public School Construction Fund.  The third concern raised by legislators was how the Washington Public Trust could avoid being continuously gutted or “swept” by the State legislature the way the Public Works Trust Fund and the School Construction Trust Fund have been gutted of over two billion dollars during the past six legislative sessions. The Washington Public Trust bill includes the creation of a five member Commission of Statewide elected officials (the governor, the lieutenant governor, the state treasurer, the superintendent of public instruction and the commissioner of public lands). The Commission in the Washington Investment Trust is also five statewide elected officiers but the officiers are different ((the governor, the lieutenant governor, the state treasurer, the auditor and the Attorney General). Because the Auditor is responsible for independently auditing the Trust, this person should not also be on the commission for the Trust they are auditing.

The third concern raised by legislators was how the Washington Public Trust could avoid being continuously gutted or “swept” by the State legislature the way the Public Works Trust Fund and the School Construction Trust Fund have been gutted of over two billion dollars during the past six legislative sessions. The Washington Public Trust bill includes the creation of a five member Commission of Statewide elected officials (the governor, the lieutenant governor, the state treasurer, the superintendent of public instruction and the commissioner of public lands). The Commission in the Washington Investment Trust is also five statewide elected officiers but the officiers are different ((the governor, the lieutenant governor, the state treasurer, the auditor and the Attorney General). Because the Auditor is responsible for independently auditing the Trust, this person should not also be on the commission for the Trust they are auditing.

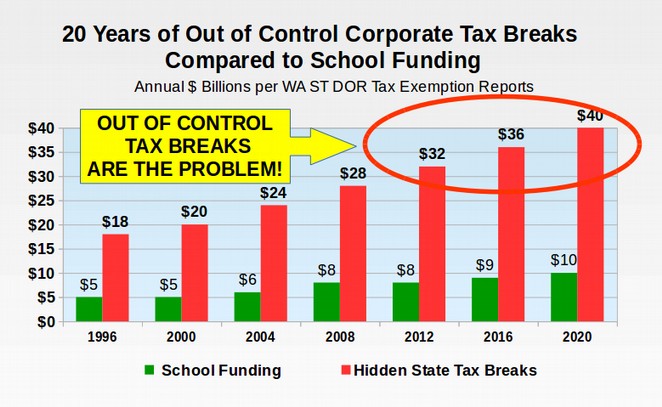

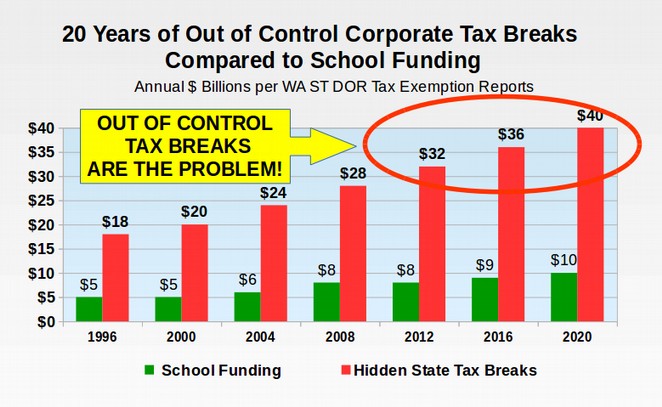

The Washington State Public Works Trust Fund is a revolving account that has been used by local governments such as cities and counties to fund more than $2.8 billion dollars in 2,000 public works projects over the past 30 years at an extremely low interest rate of one to two percent. During this 30 years, there has not been a single default. The agency is/ was self sustaining and cost effective. This agency is or was the closest thing Washington State has to a Public Bank or a Public Trust. When the Public Works Assistance Account (PWAA) was established in 1985, it was funded by small increases in utility and real estate excise taxes. Here are links to the funding legislation, along with the amounts that formerly went to fund loans: • Real Estate Excise Tax or REET: (RCW 82.45.060) 6.1% of the REET collected • Public Utility Tax: (RCW 82.16.020) 0.94% water tax, 2.16% sewer tax • Solid Waste Collection Tax: (RCW 82.18.020) 3.6% solid waste (SW) tax Recently these sources of funding have been almost entirely diverted. Currently the only money going into the Public Works Trust Fund account is a small 2% of the REET and loan repayments from the past 30 years of loans. Even these loan repayments of about $200 million per year have been “swept” from the Trust Fund because the Trust Fund is not a “protected” Trust Fund. The Public Works Trust Fund therefore has been repeatedly gutted by our State legislature to backfill for hunderds of tax exemptions like the billion dollar per year Boeing Tax Break. Virtually every part of our government from public schools to public works has been gutted in order to pay for these 700 tax breaks to wealthy corporations. These hidden tax breaks for the rich now cost our state almost $40 billion per year.  History of the Public Works Trust Fund Train Wreck PWAA was established because local agencies such as small cities and counties were not able to fund critical Public Works projects essential to public health and safety.

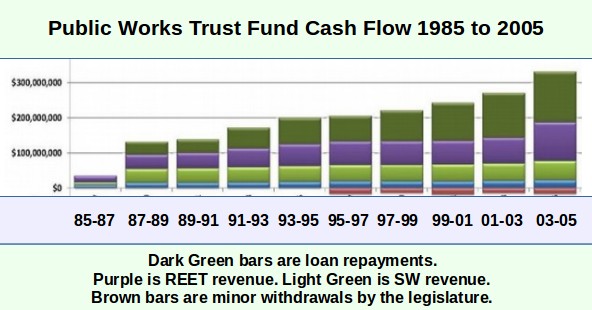

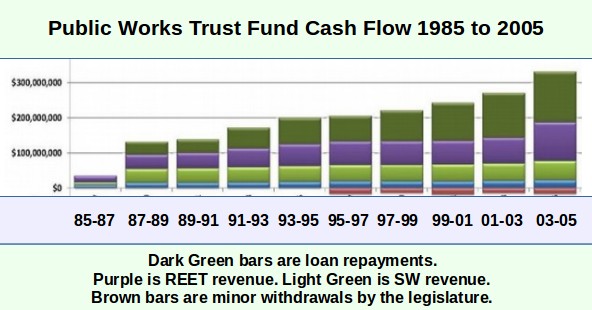

History of the Public Works Trust Fund Train Wreck PWAA was established because local agencies such as small cities and counties were not able to fund critical Public Works projects essential to public health and safety.  We are now dealing with how to repair or replace aging infrastructure with very high replacement costs. The removal of this funding for Public Works projects is certain to result in system failures all across our state which will harm public health and safety. For the first 10 years, the Public Works Trust Fund had a stable source of funding from Real Estate Excise and Solid Waste Taxes of about $100 million per year. By 1995, this created a total fund balance of nearly one billion dollars for Public Works projects. While there were small withdrawals during the second 10 years, they were offset by increases in the Real Estate Excise and Solid Waste Taxes so that by 2005, there was more than $2 billion in the Public Works Trust Fund. Here is a graph of these first 20 years:

We are now dealing with how to repair or replace aging infrastructure with very high replacement costs. The removal of this funding for Public Works projects is certain to result in system failures all across our state which will harm public health and safety. For the first 10 years, the Public Works Trust Fund had a stable source of funding from Real Estate Excise and Solid Waste Taxes of about $100 million per year. By 1995, this created a total fund balance of nearly one billion dollars for Public Works projects. While there were small withdrawals during the second 10 years, they were offset by increases in the Real Estate Excise and Solid Waste Taxes so that by 2005, there was more than $2 billion in the Public Works Trust Fund. Here is a graph of these first 20 years:  Then the trouble began.

Then the trouble began.

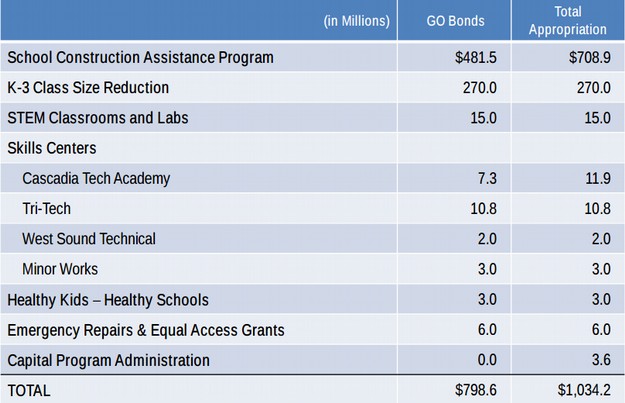

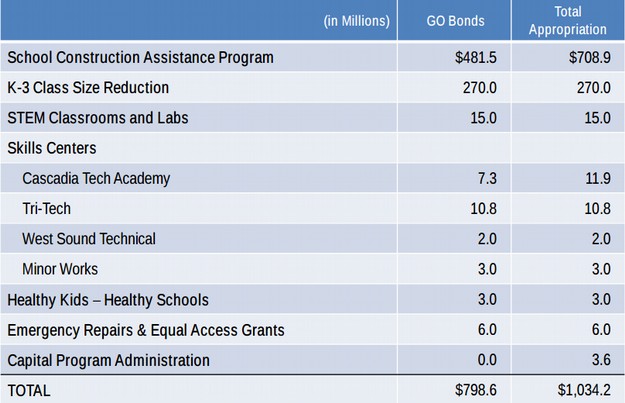

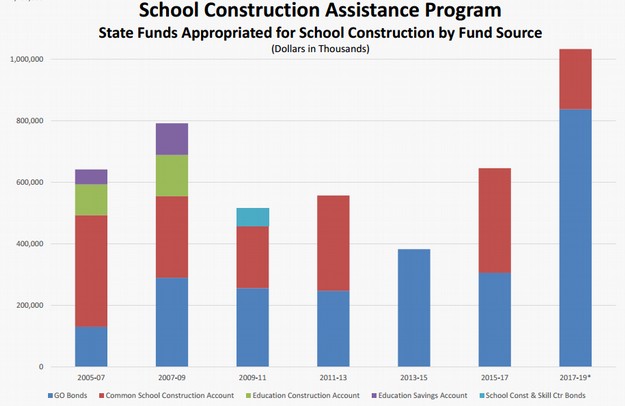

On January 31, 2017, the House Capital Budget Committee held a hearing on the School Construction Budget. There were several important topics reviewed at this meeting. #1. Report of the School Construction Technical Work Group. #2. Overview of the School Construction Assistance Program. #3. Pre-Disaster Mitigation Plan. #4. Washington State University Inventory and Condition of Schools Report. #1. Report of the School Construction Technical Work Group. Here is a link to the first slide presentation: https://app.leg.wa.gov/CMD/Handler.ashx?MethodName=getdocumentcontent&documentId=Shk_0HI9INA&att=false The current Governor’s proposal is $800 million in new General Obligation (GO) bonds plus another $200 million in existing bonds:  Thus, the proposal is to only spend about $400 million per year on school construction and repair. This is about one percent of what is actually needed. Given that our State has a $40 billion school construction backlog, it would take 100 years to address just the current backlog of more than 1000 crumbling schools – schools that do not meet the health code or earthquake code standards including hundreds of schools with lead in the water. Thus, this proposal is simply a crime against our children by forcing them to spend their school days in unsafe and unhealthy schools – all so our legislature can continue to pay Boeing and other wealthy corporations billions of dollars per year in tax breaks. The following table shows that there is about $200 million in cash sitting in the School Construction Match Account:

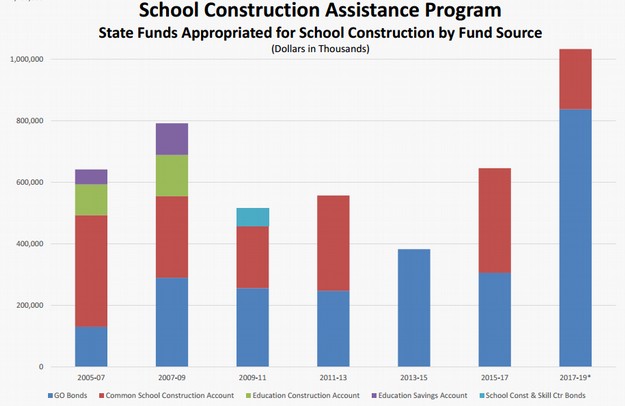

Thus, the proposal is to only spend about $400 million per year on school construction and repair. This is about one percent of what is actually needed. Given that our State has a $40 billion school construction backlog, it would take 100 years to address just the current backlog of more than 1000 crumbling schools – schools that do not meet the health code or earthquake code standards including hundreds of schools with lead in the water. Thus, this proposal is simply a crime against our children by forcing them to spend their school days in unsafe and unhealthy schools – all so our legislature can continue to pay Boeing and other wealthy corporations billions of dollars per year in tax breaks. The following table shows that there is about $200 million in cash sitting in the School Construction Match Account:  The following chart shows that the legislature used to actual provide funds from the General Fund (basically lottery funds) to fund school construction. But the new plan is to pay for school construction exclusively with bonds to Wall Street banks:

The following chart shows that the legislature used to actual provide funds from the General Fund (basically lottery funds) to fund school construction. But the new plan is to pay for school construction exclusively with bonds to Wall Street banks:  The problem with this plan is that smaller school districts do not have the tax base to pass a school construction bond. They there can not qualify for state matching funds as there is nothing to match. This is contrary to several sections of our State Constitution including Article 9, Section 2 which calls for a uniform system of public schools without regard the zip code that the child lives in.

The problem with this plan is that smaller school districts do not have the tax base to pass a school construction bond. They there can not qualify for state matching funds as there is nothing to match. This is contrary to several sections of our State Constitution including Article 9, Section 2 which calls for a uniform system of public schools without regard the zip code that the child lives in.

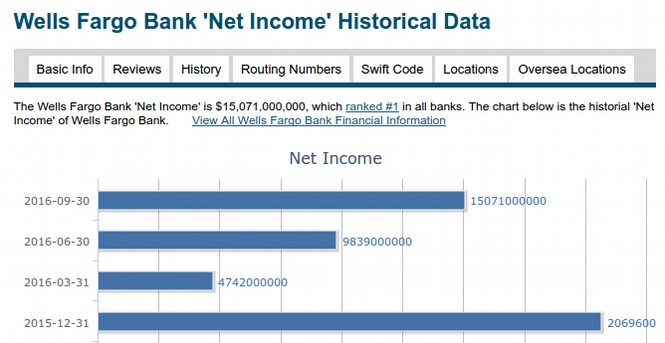

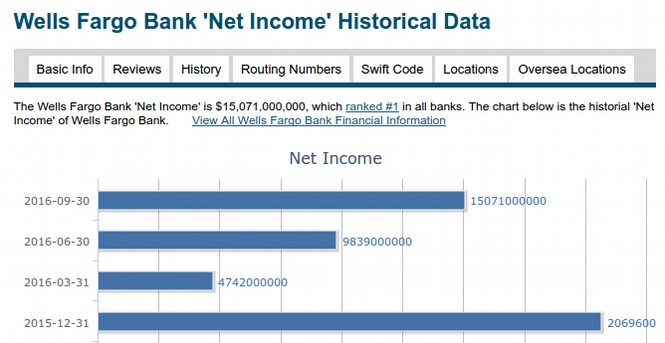

Every year since 2009, we have tried to pass a bill in the Washington legislature to create a public bank. A public bank could save our state’s tax payers billions of dollars per year in interest payments currently being paid to private for profit Wall Street banks. So one would think that a public bank would be a “no brainer.” The biggest opponent of a public bank has been the lobbyist for the big Wall Street banks who has claimed that private banks “could not compete” with a public bank and would be driven out of business. The goal of this article is to show how a public bank and private bank serve dramatically different purposes – a public bank and private bank can co-exist in the same state without the public bank threatening the survival of the private bank. We will use the State of North Dakota which has their own “Public Bank of North Dakota” as well as 20 branches of a big Wall Street bank called Wells Fargo. Our hope is that if legislators have a better idea of how public and private banks really operated, they will better understand why public banks do not threaten the existence of private banks and will pass a public bank bill here in Washington state. How Wells Fargo Operates… An Example of a Private For Profit Bank In 49 out of 50 states, private banks enjoy a complete monopoly. The only state in the US with a public bank is the state of North Dakota. Wells Fargo has 20 branches in North Dakota. Nationwide, Wells Fargo has total deposits of $1.2 trillion, net equity (assets minus liabilities) of $159 billion and a net annual income (for the past four quarters) of $50 billion. Thus, Wells Fargo has a ‘return on equity of 30% per year. http://www.usbanklocations.com/wells-fargo-bank.shtml As of December 31, 2016, Wells Fargo had net loans of $934 billion. Thus, the “leverage” or loan to equity ratio is $934/159 or about six to one. Put another way, Wells Fargo has about 6 times more loans than it has equity. Many banks have ten times more loans than they have equity. This is called “Fractional Reserve Banking.” When a private commercial bank makes a loan, they do not actually loan out money from their own assets. Instead, they create both an asset and a liability on their balance sheet. Some call this generating money out of thin air. But it is really just a standard banking practice. http://www.ibanknet.com/scripts/callreports/getbank.aspx?ibnid=usa_451965 How Private Wall Street Banks Really Make Money Many people think that Wells Fargo and other private banks make money by charging more interest on their loans than they pay on their deposits. But this is not the case. There is not actually much difference between the interest they earn and the expenses they have. For example, if Wells Fargo charges an average of 5% interest on their $931 billion in loans (including everything from Home loans to Credit card loans) while they pay an average of 2% interest on their $1.2 trillion in deposits, they would make $46 billion on their loans but pay $24 billion on their deposits. However, Wells Fargo has about a one percent default rate or $10 billion. They also have to pay wages for thousands of employees ($32 billion), pay rent on 6,000 branches and pay for everything from advertising to electricity (amounts unknown). In fact, Wells Fargo made $40 million on loans, $9 billion on government bonds, and $4 billion in “other interest” for total interest income of $53 billion. Meanwhile, they paid out $6 billion in Interest expense, $32 billion in employee costs and an unknown amount for electricty, rent and advertising. When you add up all of these expenses, there is not much difference between interest in and expenses out. So where does Wells Fargo make $50 billion per year? http://data.cnbc.com/quotes/WFC/tab/7.2

As of December 31, 2016, Wells Fargo had net loans of $934 billion. Thus, the “leverage” or loan to equity ratio is $934/159 or about six to one. Put another way, Wells Fargo has about 6 times more loans than it has equity. Many banks have ten times more loans than they have equity. This is called “Fractional Reserve Banking.” When a private commercial bank makes a loan, they do not actually loan out money from their own assets. Instead, they create both an asset and a liability on their balance sheet. Some call this generating money out of thin air. But it is really just a standard banking practice. http://www.ibanknet.com/scripts/callreports/getbank.aspx?ibnid=usa_451965 How Private Wall Street Banks Really Make Money Many people think that Wells Fargo and other private banks make money by charging more interest on their loans than they pay on their deposits. But this is not the case. There is not actually much difference between the interest they earn and the expenses they have. For example, if Wells Fargo charges an average of 5% interest on their $931 billion in loans (including everything from Home loans to Credit card loans) while they pay an average of 2% interest on their $1.2 trillion in deposits, they would make $46 billion on their loans but pay $24 billion on their deposits. However, Wells Fargo has about a one percent default rate or $10 billion. They also have to pay wages for thousands of employees ($32 billion), pay rent on 6,000 branches and pay for everything from advertising to electricity (amounts unknown). In fact, Wells Fargo made $40 million on loans, $9 billion on government bonds, and $4 billion in “other interest” for total interest income of $53 billion. Meanwhile, they paid out $6 billion in Interest expense, $32 billion in employee costs and an unknown amount for electricty, rent and advertising. When you add up all of these expenses, there is not much difference between interest in and expenses out. So where does Wells Fargo make $50 billion per year? http://data.cnbc.com/quotes/WFC/tab/7.2

The following is the proposed text of the Washington Public Trust Act: AN ACT Relating to establishing the Washington Public Trust; amending RCW 42.56.270, and 42.56.400; adding a new section to chapter 39.58 RCW; adding a new section to chapter 41.06 RCW; adding a new chapter to Title 43 RCW; creating a new section; providing an effective date; providing an expiration date; and declaring an emergency.

BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF WASHINGTON:

NEW SECTION. Sec. 1 FINDINGS--INTENT.

(1) The legislature finds that there are urgent unmet public infrastructure needs.

(2) The legislature finds that these urgent unmet needs include but are not limited to a public school construction and repair backlog of more than $40 billion dollars with more than half of our public schools being more than 50 years old and not meeting either health code or earthquake code standards. Because many school districts are simply unable to pass school construction bonds, the current School Construction Matching Program has not been an adequate or efficient model for building and/or repairing our crumbling public schools.

(2) The legislature further finds that these urgent unmet needs also include the need to replace the Public Works Trust Fund with a more sustainable model. While the Public Works Trust Fund in the past has invested in more than two billion dollars in Public Works projects and returned hundreds of millions of dollars in additional revenue to the State General Fund as a result of these investments, the Public Works Trust Fund suffers from the fatal defect of being at risk of having its assets stripped any time there is a shortfall in the General Fund.

(3) The legislature further finds that both Public Works Trust Fund and Public School Construction fund are an ineffecient use of tax payer resources because they require excessive fees to bond writers and private banks.

(4) The legislature further finds that these fees and interest charges are unwarrented because no school district, city, county or other public agency in Washington state has ever failed to fulfill its financial obligations. Indeed, most public agencies are required by law to faithfully fulfill their financial obligations. It is therefore not appropriate to treat investments in public works and public school projects as “debt” which by its very nature is a financial contract that is subject to the risk of non-payment.

(5) The legislature further finds that since public works and public school projects are not subject to risk and since these public projects by their very nature offer a long term and essential public benefit, they are more accurately classified as public investments – just as investing in public schools is not a debt but instead is a public investment in the future of our children.

(6) Therefore, the legislature intends to create the Washington Public Trust as a statewide institution in order to better facilitate our State's Public Infrastructure needs now and in the future.

(7) The legislature intends that the Washington Public Trust may facilitate investment in public infrastructure projects that increase public health and safety as well as assisting our state in meeting its paramount duty to build and operate our public schools;

(8) The legislature intends that the Washington Public Trust will be protected from the risk of having its assets stripped by the legislature by better insulating its funds from short-sighted and capcricious withdrawals by the legislature that have in recent years led to the destruction of the Washington Public Works Trust fund. This protection will be provided through the creation of a Washington Public Trust Commission consisting of five Statewide elected officials the majority of whom will have to certifiy that funds can be removed from the Washington Public Trust from time to time in a manner that will not significantly impare the ability of the Trust to invest in essential and urgently needed public projects.

(10) The legislature intends to capitalize the Washington Public Trust with funds remaining in the Public Works Trust Fund and Funds from the School Construction Fund as well as other public funds as determined by the commission.

(11) The legislature intends that while the Washington Public Trust is to be similar in some respects to the Public Bank of North Dakota, it will be different from the Public Bank of North Dakota in that the initial operation of the Washington Public Trust will be substantially more limited than the Public Bank of North Dakota and shall not be expanded in scope until such time as additional functions are authorized by the Washington State legislature.

(12) The mission of the Trust is to more efficiently utilize Washington's public resources for the benefit of the people and economy of our state. The legislature intends for the Public Trust to apply sound business practices to manage revenues while concurrently meeting identified public needs across the state. In achieving its purpose of improving public infrastructure, the legislature intends for the Public Trust to adhere to the following priorities:

(a) Institutional safety, soundness and long term viability;

(b) Social return and monetary return on investments;

(c) Prudent and best business practices; and

(d) Highest ethical, accountability, and transparency standards.